7 Lessons On Strategies

The Rich Use To Buy Annuities

Lesson #7

Advanced Annuity Plan Case Study

Review a case study based on real life scenarios using the advanced annuity

planning techniques discussed throughout these 7 lessons; and experience first hand the powerful results that can be achieved through the correct use of annuities during retirement.

Case Study Assumptions

Bill and Susan Johnson, ages 62 and 55, have been happily married for close to 33 years. The couple is retired and in excellent heath. Bill and Susan have two children, ages 31 and 28. Both children have stable jobs and they each have two children of their own.

The Johnson’s have lived in the same home for 20 years and have no desire to ever move. The home has no mortgage, and is valued at $375,000. Bill and Susan have no debts.

Last month, the couple sold their business for $150,000. The buyer is paying them $50,000 for each of the next three years. The Johnson’s, who are in a 32% combined state and federal income tax bracket, have the following assets:

-$500,000 in A-rated corporate bonds (7% coupon, due 2022)

-$200,000 in the ABC Balanced Mutual Fund

-$100,000 in the XYZ Growth & Income Fund

-$50,000 in the LMN Small Cap Growth Fund

-$30,000 in an interest-bearing checking account

-$700,000 in the GHI Fixed-Rate Annuity (IRA account, earns 4% a year)

The couple expects to live a long time—their parents are in their 90s and healthy. Bill and Susan know very little about investing. When it comes to risk, Bill is “fairly aggressive” and Susan is “conservative.” They want to avoid investment losses during retirement and naturally are concerned about the possibility of inflation and outliving their life savings.

When the second spouse dies, the couple would like to leave as large an estate as possible to their two children, four grandchildren, and some to their church.

The Johnsons are open to any ideas and would especially like to know answers to the following questions:

1. How to get $45,000 a year in pre-tax income to live comfortably.

2. What annuities are and how they work.

3. What the terms variable, fixed-rate, equity-indexed and living benefit mean.

4. Pros and cons of annuities and why the press is generally negative about

annuities.

5. If annuities are a good idea for part or most of their portfolio.

After meeting with a Retirement Planning Institute Senior Instructor the Johnsons received the following summary proposal letter.

Dear Mr. and Mrs. Johnson,

Thank you for your time this past Tuesday afternoon. I enjoyed meeting with you both and was happy to hear that you found value in some of the unique topics that we covered. In preparation for our next meeting, I have outlined a brief summary of our previous discussion:

Needs and Objectives: You indicated that the following objectives were important to you:

1. How to safely generate $45,000 per year of gross income.

2. What annuities are; how they work; and what specifically a variable, fixed-rate, and equity indexed annuity is; and whether they make sense for a portion or even majority of your retirement savings.

3. What “living benefits” are, and why you sometimes hear negative press about annuities.

4. How to best preserve principal throughout retirement in order to make certain you never run out of money and are able to pass the largest possible estate to your two children.

Annuities Overview: An annuity is a contract between you and an insurance company in a similar manner to how a certificate of deposit is a contract between you and a bank. The reason it is called a “fixed” annuity is because it guarantees a stated interest rate and therefore carries no investment risk (as opposed to a “variable” annuity which typically invests in non-guaranteed investments such as mutual or bond funds, which can potentially lose value).

It is possible to add a “living benefit” to a variable annuity, which I recall you asking about during our meeting. A “living benefit” can guarantee a lifetime income stream regardless of whether the underlying account value has declined as a result of market losses. However, there are typically additional rider fees for adding such a feature.

There are two main types of fixed-rate annuities: immediate and deferred. An immediate fixed annuity is what someone purchases when they want to turn a specific asset into a series of income payments. The reason it is called an immediate annuity is because once you purchase the annuity from the insurance company, most of the time your principal is “immediately” turned into a stream of monthly income payments that last for a certain length of time (or are guaranteed for life depending on the payout option you choose). The benefit of this type of annuity is that your income payout is guaranteed and insured by the insurance company.

The negative side of this type of annuity is that while you may receive guaranteed monthly checks for a period of time (or over your lifetime), the payments are typically without inflation adjustments, the actual growth rate you receive on your principal during this payout is usually quite low, and once you begin an immediate fixed annuity, you are typically required to lock into an irreversible decision with no recovery of lump sum principal at the other end for yourself or your beneficiaries.

In contrast, a deferred fixed annuity functions more like a certificate of deposit. The money you use to purchase a deferred fixed annuity is guaranteed to receive a stated rate of return for a specific number of years. Your principal is guaranteed and insured by the insurance company, and at the end of your contract term you are able to withdraw 100% of your account value without penalty.

The benefits of this type of fixed annuity are that your money grows tax deferred, there are no annual fees, and you are allowed to make withdrawals of up to 10% of your account value, every year without penalty. For income purposes, this withdrawal feature can, in many cases, make annuities more flexible than a bond or certificate of deposit, which do not allow you to access your principal during the commitment period. The negative side of this type of fixed annuity is that while you are allowed to take 10% out per year, you are still limited in respect to overall liquidity and flexibility.

An equity-indexed annuity is a type of deferred fixed annuity where your growth is typically linked to a specific index, such as the S&P 500. Gains are credited annually (if the index rises) but are usually subject to either a “cap” or “participation rate”. In simple terms, you are usually not allowed to participate in the full upside of the index growth; but on the other hand, most equity indexed annuities are structured so you never participate in the downside either. The end result is a high level of safety and peace of mind when it comes to your principal, yet with the opportunity to earn higher interest that what might otherwise be earned in a traditional fixed rate annuity.

Annuities and Financial Planning: Some people have great experiences with annuities, while some people have poor experiences. In most cases those individuals who have had a bad experience with annuities had one for the same reasons that they might have with any other type of investment – when that investment was sold or structured incorrectly in relation to their investment needs or objectives. Unfortunately, those are the stories you typically hear about in the press. The bottom line is that annuities are no different than most other investments – meaning they can come with both good parts and bad parts.

However, suppose for a moment that instead of just simply purchasing a single annuity by itself, what if these same annuities could be structured within a more advanced strategy? What if by doing so we could substantially magnify the benefits that annuities can offer, while at the same time reduce or even eliminate the negative features?

Here is an example of exactly how an idea like this could work for you personally:

First, instead of taking your assets and just purchasing one big annuity, we divide your nest egg into smaller, more easily manageable annuities called “legs” that are each designed with a specific purpose. We then deposit the correct mathematical amount into each leg and structure these legs in the proper sequence. Some legs are designed to pay you income, and some legs are designed to keep replenishing your nest egg’s original balance. This is sometimes referred to as a “split annuity” or “laddered annuity” plan.

The effect is that you will have a continuous stream of retirement income that keeps getting bigger over the years, and you never deplete your original principal. The last “leg” in the ladder is always designed to re-grow your original principal by the time you get to it, thereby solving both your request for comfortable lifetime income, as well as preserving a large lump sum principal balance to be passed first to the surviving spouse, and then ultimately to your children.

Furthermore, because we typically use short term (5-7 year contracts) deferred fixed annuities to build your “ladder”, you never have to lock into an irreversible decision (like in an immediate lifetime annuity settlement), your nest egg is never tied up at low “annuitization” rates, and every couple of years you have the option of either walking away with your entire principal penalty free, or continuing with the program and watching your monthly income keep getting bigger.

Now, instead of just purchasing a single investment product, you have an actual strategy for providing yourself with a steadily rising retirement income stream while at the same time never depleting or forfeiting your principal. This is how annuities can be used so that the good features are magnified and the bad features are reduced or even eliminated entirely! Now that we have reviewed the basics of annuities and how to use them in the most advantageous manner, let’s look at some specific applications.

Proposed IRA Solution: The IRA solution that I am recommending is designed specifically to accomplish every one of the objectives you originally shared with me, as well as incorporate some additional benefits that will add increased value to your overall retirement.

The challenge with IRA money is that it is subject to the IRS’ Required Minimum Distribution (RMD) rules once you turn 70.5 years of age, and must therefore be managed carefully throughout retirement in order to avoid substantial penalties. The RMD withdrawal requirement forces you to withdrawal a larger and larger amount for every year you age beyond 70.5, thereby depleting your account.

Therefore, if you were to continue on your current path, your IRA balance will likely be depleted significantly over the course of your retirement in an effort to stay compliant with the ever increasing RMD. Then, whatever reduced amount is still remaining at the end of your lifetime will still be fully taxable to your beneficiaries and included in your estate.

Because of these limitations, it is not uncommon for heirs to receive only 20-30% of the value of what that IRA was originally worth at the start of your retirement – clearly in direct contrast to your stated goals.

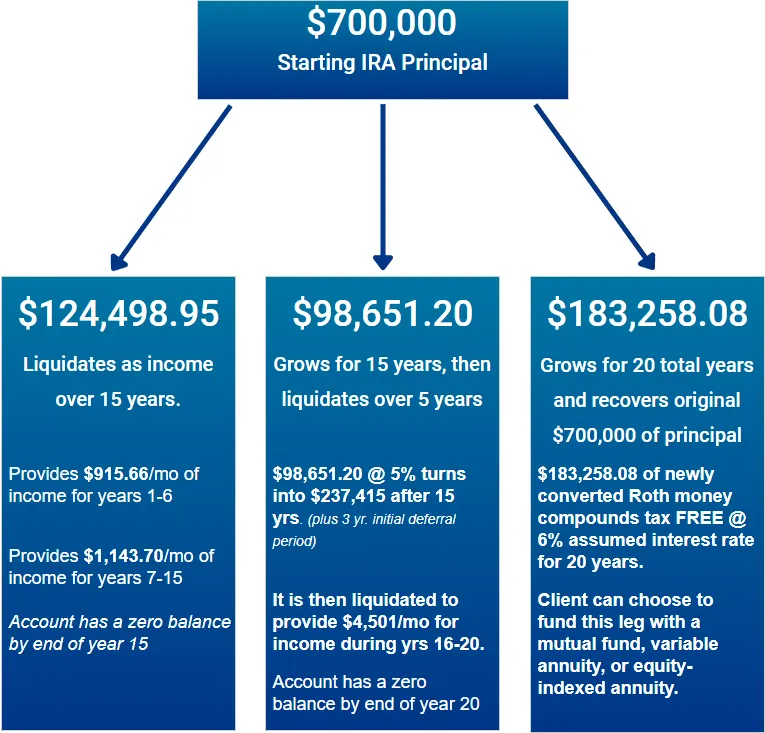

My recommendation is to structure Bill’s $700,000 IRA annuity principal within the laddered fixed annuity program that is illustrated below. We will need to initiate partial, tax-free transfers of your existing IRA annuity into your new properly structured annuity portfolio, so we will need to stay mindful of any existing surrender charges in your current annuity prior to transferring any money.

The third leg or “recovery” leg of the plan will be converted to a Roth IRA. By converting only the balance of leg three ($183,258.08) instead of the entire $700,000 IRA principal, it will cost significantly less taxes (only $58,642.59) than if you were to perform a full conversion of your entire IRA (which could be several hundred thousand dollars of taxes in contrast).

Because of the sale of your business this year, I recommend waiting until at least January of 2010 to actually convert the balance of leg 3 to a Roth, in order to qualify for additional tax benefits/purposes that we can discuss in greater detail in our next meeting.

However, the main point is that once it is converted, the balance of your recovery account (leg 3) will be fully exempt from the RMD requirement in the future, will re-grow your full original IRA principal tax-FREE over the next 20 years, and because it is within a Roth annuity, it will not only pass income tax FREE to your beneficiaries, but also bypass the costs and delays of probate.

This can potentially end up saving between 50-80% of your original $700,000 balance that will now pass to your children, instead of being depleted by the RMD and/or reduced heavily by taxation at death.

The remainder of your traditional IRA balance left over after converting leg 3 to a Roth ($700,000 - $183,258.08 converted to a Roth in leg 3 = $516,741.92) will be used to fund the first two income legs of your laddered annuity portfolio. That will allow it to begin generating $3,077 per month of income that will steadily rise to $4,501 per month over the next 20 years.

In summary, by building your laddered IRA annuity portfolio with a combination of fixed and equity-indexed annuities, you will start with $700,000 of fully taxable IRA principal, receive over $907,000 of total retirement income during the next 20 years, and recover $700,000 tax FREE at the end of 20 years - all without exposure to market risk and with little or no fees!

The entire laddered portfolio can grow and enjoy undisturbed compound interest for the next 3 years first, before providing income, since your current income needs are already being met by the proceeds from the sale of your business.

The conversion taxes can easily be paid out of your non-IRA assets. Below is a sample flow chart of how the program will look:

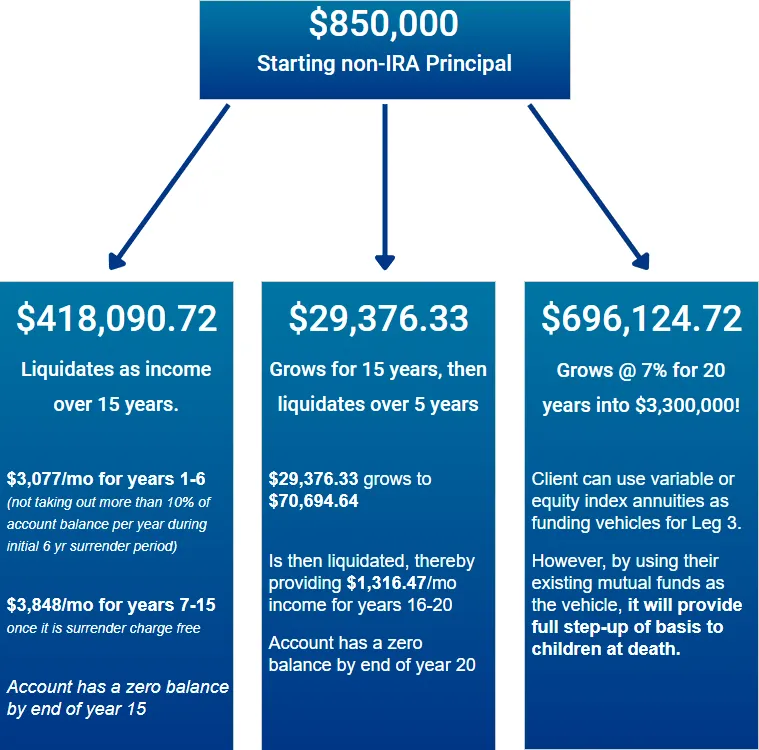

Proposed Non-IRA Solution: The non-IRA solution that I am recommending is also designed to simultaneously accomplish all of the objectives you listed, yet like the IRA solution, it can also be designed to include some additional valuable benefits that will provide you with even greater results.

During our meeting we discussed how our laddered annuity program is designed to liquidate principal and interest at the same time in the form of monthly income. Since your non-IRA money is already after-tax principal, that means that when we allocate your asset across our

portfolio model, the starting balances of each leg therefore also consist of tax-free principal.

Once we begin liquidating the first account of your portfolio as income, a very large percentage of your annual income will be documented as a return of principal, as opposed to all taxable interest.

Currently, the $500,000 of assets you have allocated to bonds is earning 7%. However, once we apply your 32% tax bracket, you are really only netting an after tax return of 4.76%, not to mention having $35,000 of fully taxable interest income showing up on your tax return every

year. This can have a negative impact on your other sources of retirement income, especially Social Security.

Because the proceeds from the sale of your business will cover your income for the next 3 years, and the laddered IRA annuity portfolio I have designed for you will already be generating $36,924 of the

$45,000 annual income you are requesting after that, that means the majority of your non-IRA assets can be used for capital appreciation and deferred growth over the years, instead of income.

Once again, we can turn to the benefits of a laddered annuity portfolio in order to give you the additional supplemental income you need in order to get to the $45,000 per year desired goal, but do so while incorporating significant tax advantages and long term appreciation of your total portfolio balance along the way.

We can do this by simply adding up the total value of your non-IRA assets, minus your emergency account of $30,000 - since I recommend you keep that available and liquid purely for emergency purposes. That gives us $850,000 of investable assets to work with, and since you

only need a fraction of the income that a laddered annuity portfolio is capable of producing, we can now “instruct” leg 3 (the recovery leg) to re-grow MUCH more than 100% of your original principal.

In fact, as you can see in the example on the next page, by allocating your $850,000 correctly, you can produce all the additional, supplemental income you need, and actually recover $3,300,000 at the end of 20 years!

With an assumed starting balance of $850,000. The non-IRA annuity ladder program will generate an estimated gross income of $269,477 over the next 20 years, but your total, 20-year estimated tax bill on that income is only $36,982!

That is the equivalent of being in a 13% tax bracket (if there were such a thing) on that specific non-IRA income stream, even though you are actually in a 32% combined tax bracket. Your recovered principal at the end of 20 years is estimated to be $3,300,000!

Summary: In response to one of your original questions during our meeting: Yes, I do believe that using a combination of properly designed annuities, in addition to some of your existing mutual funds, would be an excellent idea for a significant portion of your total assets. The reason, of course, is that it will allow you to create stable, predictable income and enjoy lower overall risk within your portfolio, while still providing excellent opportunities for long-term growth and protection against inflation.

If you would like my help in constructing both portfolios (the IRA and non-IRA), then the combined income streams (starting at Bill’s age 65) would produce $47,919 of annual income for the first 6 years, $59,868 of annual income for the middle 9 years, and $70,027 of annual income for the final 5 years. That is a total income payout of $1,176,434, between Bill’s ages 65 to 85, while still recovering your full Roth IRA lump sum

balance of $700,000 income tax FREE at the other end, along with

$3,300,000 of non-IRA assets.

As I have illustrated throughout this summary, both the IRA and non-IRA portfolios come with a very unique set of benefits that are difficult to duplicate through other conventional planning solutions. Our total solution would completely satisfy every one of the objectives that you said you wanted:

1. Your principal can be safeguarded against loss because it is backed by some of the largest, most stable institutions in the world at all times.

2. Your assets are diversified among multiple “A” and “A+” rated insurance companies.

3. Your income is protected against inflation because it is designed from the very beginning to rise substantially throughout your retirement. In addition, because we are preserving your flexibility to move into new, higher interest annuities down the road, that will also provide significant inflation protection.

4. Your principal balance is not only maintained throughout the plan but enjoys an appreciation of roughly 300% - while we are paying you over $1,176,434 of income along the way at the same time! This would not have been possible otherwise (at least not with your IRA money because of the RMD requirements choking your future growth.)

5. We are able to easily meet and even exceed the additional income request of $45,000 per year (assuming that we have both portfolios running.)

6. Susan, your request for a conservative solution is met by producing 20 years of safe, predictable income (by using guaranteed fixed annuities in the first two legs of each plan). And Bill, your request for slightly higher risk or aggressive opportunities is met by using equity-linked vehicles in the long-term recovery legs (leg 3). Now, you can both feel comfortable taking on some stock market participation over the long term, and yet because of our design, even a large stock market loss should have no negative impact whatsoever on the next 20 years of your income!

7. Because Susan is younger than age 59.5, we recommend structuring both portfolios with Bill as the owner and annuitant, Susan as the sole primary beneficiary (in order to preserve spousal continuation privileges), and the children as contingent beneficiaries.

8. By using a Roth IRA for the recovery-leg of your IRA portfolio, and mutual funds (which receive a step-up in basis at your death) for the recovery leg of your non-IRA portfolio, your beneficiaries now stand to share a $4,000,000 inheritance that is income tax FREE and that can be divided between your heirs and your church in any manner you wish!

I hope that this summary was helpful and will aid you in making an educated and comfortable decision. I look forward to getting back together with you next week. If you have any additional questions in the meantime, please do not hesitate to contact me.

Sincerely,

Eric Couch